FOR VENDORS

A gateway to industry leaders

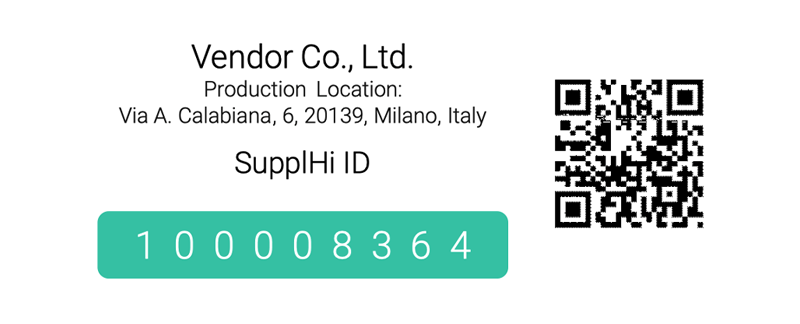

SupplHi is the entry point for Vendor Qualification of some of the most cutting-edge players of B2B industries.

Free-of-charge

No subscription fees nor commissions. Registration on SupplHi is always free-of-charge for Vendors of any dimension, from any country around the globe.

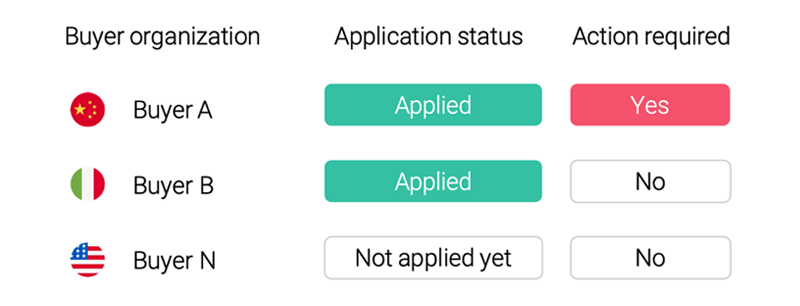

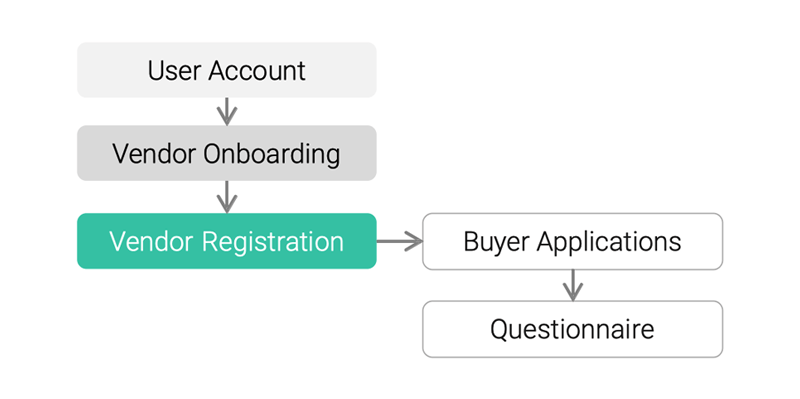

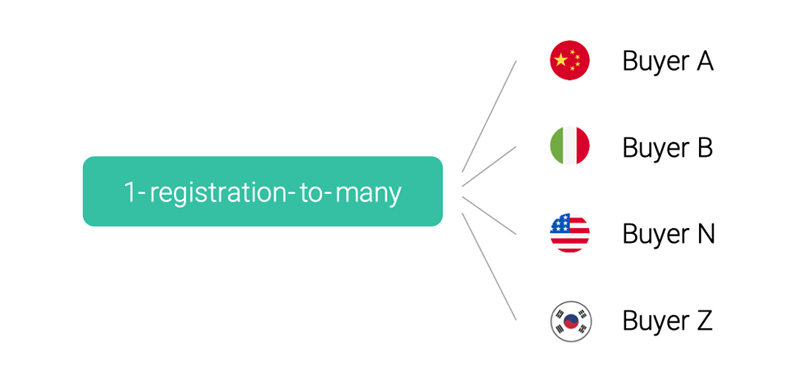

Save time and money

Provide and keep updated information for all Buyers on a single and easy-to-use platform, reducing the time spent on these activities drastically over the years.

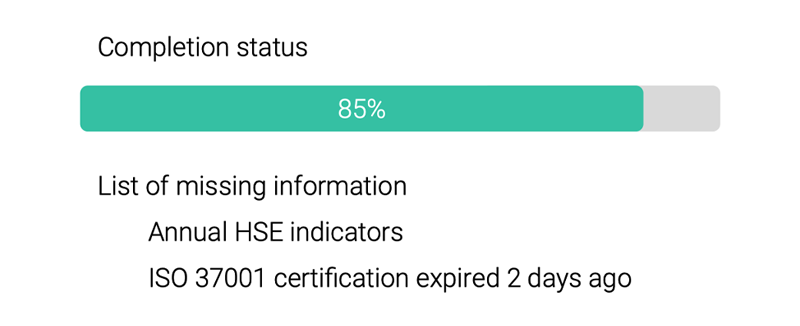

Increase your global visibility

Gain a new marketing channel to be found by a broad and global Client arena by completing and maintaining at 100% your Vendor Profile.

Promote Compliance

Register on a secure and auditable platform to indicate to Clients that you have made supply chain visibility a priority, reducing compliance and legal risks for all parties.

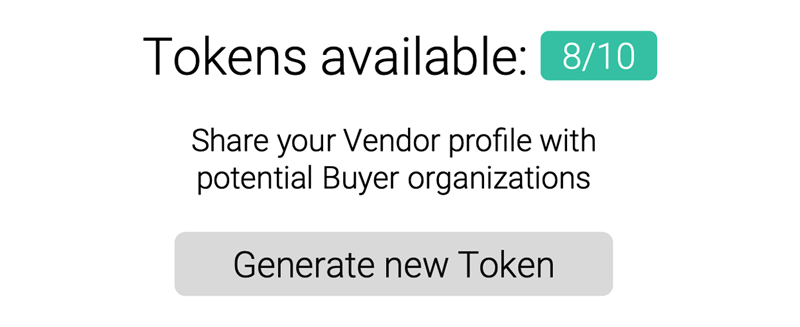

Your Company at its best

Demonstrate that you are a forward-thinking company that leverages on agile and efficient processes by generating “tokens” to share access to your Vendor Profile with Clients that are not already on SupplHi.

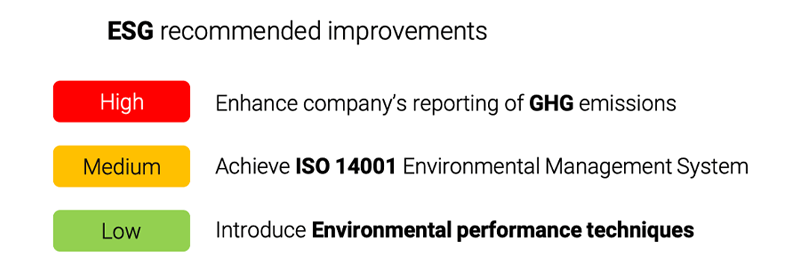

Know where to improve

Receive suggestions on where to improve in selected dimensions (e.g. Environmental, Social and Governance Sustainability) compared to the average of your competitors.

Manage your supply chain

Manage your Vendors through the most efficient and compliant tool on the market that is based on the international best practices of your same Clients.